muscles-power.ru Market

Market

403b Vs 401k Vs Ira

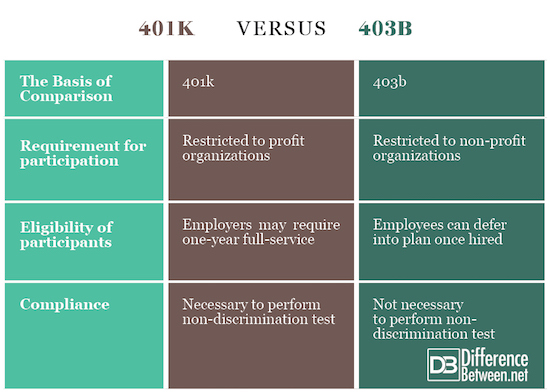

A (b) is a retirement account for employees of public schools and nonprofits. · A Roth IRA is an individual retirement account that's funded with after-tax. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. While (k) plans are primarily offered to employees in for-profit companies, (b) plans are offered to not-for-profit organizations and government employees. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. A (b) plan will be held with an employer, while an individual Roth IRA is held at a brokerage firm, with no need for management adjustments if you change. IRAs generally present a wider array of investment choices, whereas (k)s permit larger yearly contributions. If you are considering contributing to your. The good news is that you don't necessarily have to think IRA versus (k). You can save with both as long as you're qualified and heed contribution and income. (k)s are generally offered by private sector companies, while (b)s are found in public schools and some tax-exempt organizations. And you can't open a k, b, b are employer sponsored retirement accounts. k and b are basically the same thing. You put in your money, your employer. A (b) is a retirement account for employees of public schools and nonprofits. · A Roth IRA is an individual retirement account that's funded with after-tax. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. While (k) plans are primarily offered to employees in for-profit companies, (b) plans are offered to not-for-profit organizations and government employees. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. A (b) plan will be held with an employer, while an individual Roth IRA is held at a brokerage firm, with no need for management adjustments if you change. IRAs generally present a wider array of investment choices, whereas (k)s permit larger yearly contributions. If you are considering contributing to your. The good news is that you don't necessarily have to think IRA versus (k). You can save with both as long as you're qualified and heed contribution and income. (k)s are generally offered by private sector companies, while (b)s are found in public schools and some tax-exempt organizations. And you can't open a k, b, b are employer sponsored retirement accounts. k and b are basically the same thing. You put in your money, your employer.

Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). "Plus, business owners contributing to SEP, SIMPLE IRA, or Solo (k) plans can get a tax deduction for these contributions, thus not only increasing. Also worth noting is the difference between contribution limits for the Roth IRA and (b) account. Contribution limits are substantially lower in the Roth IRA. (b) vs. (k). L in e. Topic. A. B. C. (b) Non-ERISA Title I Plans with plan, (b) plan, governmental plan, IRA, or. Distribution from (b). The key difference is that (b) plans are offered by public schools, churches, and (c)(3) non-profit organizations. The (b) plan was originally created. Traditional (k), (b), and IRA contributions leave money in your pocket because they generally lower your current taxable income. But these tax savings can. ^ Jump up to: "Publication Designated Roth Accounts Under a (k) or (b) Plan" (PDF). "(k) vs Roth IRA". muscles-power.ru Thomas, Kaye A. ". Both (b) plans and (a) plans allow you to make tax-deferred contributions to your retirement. This allows you to make pre-tax contributions from your. Examples of defined contribution plans include (k) plans, (b) plans Under a SEP, an employee must set up an IRA to accept the employer's contributions. A (b) has automatic payroll deductions, the possibility of an employer match, and your contributions are tax deductible. A Roth IRA gives you more control, a. Review a required minimum distribution table that compares IRAs and defined contribution plans, such as (k), profit sharing and (b) plans. Key Takeaways · Not-for-profit employers generally offer (b) retirement plans, while for-profit employers offer (k) plans to employees. · Regular (k) and. (k) and (b), $22,, $7, Traditional IRA and Roth IRA*, $6,, $1, Traditional IRA vs. Roth IRA. If you don't have access to an employer. With nearly $ trillion in assets as of ,1 (b)s are popular retirement savings accounts. While they're less common than (k)s, (b)s are still. Traditional vs. Roth (k) / (b) / (b) Calculator · Age and retirement plan information: · Investment return and taxes: 7% return, 24% current tax rate, 1. IRA and (k) accounts let you save for retirement with tax benefits. · 2. Employers may match your contributions but limit your investment choices. · 3. IRAs. The major difference between the two accounts is the tax benefits. Contributions made to a (b) are deducted from taxable income, while contributions to a. 1. By making an IRA contribution to a Rollover IRA you may be commingling qualified plan assets (i.e., (k), (b), and. If your (k) or (b) retirement plan accepts both traditional and Roth contributions, you have two ways to save for your retirement. Both offer federal. If you expect to be in a higher tax bracket in retirement: Consider a Roth IRA for tax-free withdrawals. · If you want an employer match: A (b) might be.

Can A Company Take Your 401k

The money is always yours. You roll it to a new employers plan if they take rollovers or to an IRA. Depending on plan rules and plan quality, you might not. 1. You could face a high tax bill on early withdrawals Before you retire, your employer's (k) plan may allow you to tap your funds by taking a withdrawal . Your employer may take your (k) money if you quit your job before the money is fully vested. If your employer has a vesting schedule, and you quit your job. Leaving money with your old employer means you can't save additional funds in that account and may face limits on how you can invest. Change jobs every few. If your employer matches per pay period, you may miss out on the match for the rest of the year because you're no longer making contributions. Because of this. You can't withdraw money from your (k) before a certain age without If you need to start small, at least try to contribute as much as your employer will. If you meet the age requirement, you can begin making distributions from your former employer's (k) plan. While you won't be assessed a 10% penalty on these. That means when your vested balance is less than $5,, you can be forced to take your money out of the plan. Your former employer is required to give you. Yes. If you no longer work for the company, they're under no obligation to keep you in their system. Some companies do, but they don't have to. The money is always yours. You roll it to a new employers plan if they take rollovers or to an IRA. Depending on plan rules and plan quality, you might not. 1. You could face a high tax bill on early withdrawals Before you retire, your employer's (k) plan may allow you to tap your funds by taking a withdrawal . Your employer may take your (k) money if you quit your job before the money is fully vested. If your employer has a vesting schedule, and you quit your job. Leaving money with your old employer means you can't save additional funds in that account and may face limits on how you can invest. Change jobs every few. If your employer matches per pay period, you may miss out on the match for the rest of the year because you're no longer making contributions. Because of this. You can't withdraw money from your (k) before a certain age without If you need to start small, at least try to contribute as much as your employer will. If you meet the age requirement, you can begin making distributions from your former employer's (k) plan. While you won't be assessed a 10% penalty on these. That means when your vested balance is less than $5,, you can be forced to take your money out of the plan. Your former employer is required to give you. Yes. If you no longer work for the company, they're under no obligation to keep you in their system. Some companies do, but they don't have to.

Leaving an employer isn't the only time you can move your (k) savings. Sometimes it makes sense to roll over your (k) assets while you continue to work. Employees who participate in a SIMPLE IRA can defer a percentage of their salary to their savings account and their employer is required to either match it or. In some cases, you can roll over your old (k) to a new employer, then take out a loan. Some employers won't allow this. It's best to check with your new plan. They mustn't withdraw money unless necessary and should be cautious to avoid ruining any prospects for future retirement. Pros & Cons of Cashing Out (k). A company can hold onto an employee's (k) account indefinitely after they leave, but they are required to distribute the funds if the employee requests it or. If you leave your employer before retirement age and you are in a defined contribution plan (such as a (k) plan), in most cases you will be able to transfer. Plans can be written to allow participants to take in-service distributions from their rollover accounts at any time, regardless of age or service. For example, if you don't do a direct rollover and receive the funds from your previous employer's plan in the form of a check, a mandatory 20% withholding will. Usually, if your (k) has more than $5, in it, most employers will allow you to leave your money where it is. If you've been happy with your investment. Your employer can never take back your vested funds. However, if any portion of your (k) balance is not vested, your employer may reclaim this money. The employer can hold the funds for up to 60 days, after which the funds will be automatically rolled over to a new retirement account or cashed out. No, your old employer cannot take your (k) funds, including any contributions you made or are fully vested in from employer matching, regardless of the. Can I Withdraw From My k Early? · The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k. As part of your employee benefits offerings, a (k) retirement plan from Paychex Retirement Services can help you recruit and retain a high-quality. Can I Withdraw From My k Early? · The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k. The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you'll pay. Generally, if you withdraw money from your (k) account before age 59 1/2 employer's qualified retirement plan will depend on the terms of the plan). can reasonably be segregated from the employer's general assets Here are six steps companies can take to promote civility in their workplaces. While every plan is different in small ways, the general rule of "can't withdraw k money until you leave the company or turn " is the. In safe harbor (k) plans, all required employer contributions are always percent vested. In traditional (k) plans, you can design your plan so.

Jerry Moyes Swift Transportation

Accout adminitrator at Swift Transportation · Experience: Swift Transportation · Location: View Jerry Moyes' profile on LinkedIn, a professional. Trucking is critical to our economy. Swift Transportation (muscles-power.ru) is the largest full-truckload motor carrier in North America. It's our birthday!! Check out this photo of Jerry Moyes and others having fun from back in the day! While has been a unique year. SWIFT TRANSPORTATION CO., INC. SAINT CORPORATION. JERRY MOYES. VICKIE MOYES. THE JERRY AND VICKIE MOYES FAMILY TRUST DATED 12/11/ THE MOYES CHILDREN'S. The Beginning of Swift Transportation Carl Moyes took the next step in He and his son Jerry started Common Market, one of many small trucking companies. To contact Jerry Moyes send an email to [email protected] What company does Jerry Moyes work for? Jerry Moyes works for Swift Transportation. Swift Transportation's Post Swift founder Jerry Moyes annouced his retirement on Thursday. Thank you Jerry for your many years of leadership. Jerry Moyes is the founder, chairman and CEO of Phoenix-based Swift Transportation, one of the largest trucking companies in the nation. He is majority. " Endorsement Thank you, Jerry Moyes! “When My father and I started Swift Transportation in , we had one truck, some cotton and imported steel, and. Accout adminitrator at Swift Transportation · Experience: Swift Transportation · Location: View Jerry Moyes' profile on LinkedIn, a professional. Trucking is critical to our economy. Swift Transportation (muscles-power.ru) is the largest full-truckload motor carrier in North America. It's our birthday!! Check out this photo of Jerry Moyes and others having fun from back in the day! While has been a unique year. SWIFT TRANSPORTATION CO., INC. SAINT CORPORATION. JERRY MOYES. VICKIE MOYES. THE JERRY AND VICKIE MOYES FAMILY TRUST DATED 12/11/ THE MOYES CHILDREN'S. The Beginning of Swift Transportation Carl Moyes took the next step in He and his son Jerry started Common Market, one of many small trucking companies. To contact Jerry Moyes send an email to [email protected] What company does Jerry Moyes work for? Jerry Moyes works for Swift Transportation. Swift Transportation's Post Swift founder Jerry Moyes annouced his retirement on Thursday. Thank you Jerry for your many years of leadership. Jerry Moyes is the founder, chairman and CEO of Phoenix-based Swift Transportation, one of the largest trucking companies in the nation. He is majority. " Endorsement Thank you, Jerry Moyes! “When My father and I started Swift Transportation in , we had one truck, some cotton and imported steel, and.

Jerry Moyes is the founder, and former Chairman and CEO of Phoenix-based Swift Transportation, one of the largest trucking companies in the United States. Moyes. The complaint sent to the EEOC: I began with Swift in early at Swift Academy.I was told (after an Academy administrator called Swift's head office in. The Chief Executive Officer and Chairman of the Board of Swift Transportation and owner of the Phoenix Coyotes lives here. ” My name is Jerry Moyes and I am the founder of Swift Transportation. Today I started Swift 50 years ago driving a single truck. From the. Jerry Moyes relocated to Phoenix in and began hauling steel with his one truck, forming a partnership with a steel importer called Comm. The second day of orientation at the Swift Lewiston terminal went well. We watched a nice video about Swift Transportation and Jerry Moyes. Before Knight was founded in , Kevin, Gary, and Randy Knight all worked for Swift, helping founder Jerry Moyes build the company to the giant it is today. “. Co announces that it has entered into a definitive merger agreement with an entity formed by Jerry Moyes, the co's largest shareholder, a current Director. United States District Court, S.D. New York. Mark RUBENSTEIN, Plaintiff, v. KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC., Nominal Defendant, Jerry C. Moyes and. Swift Transportation Driving Academy (). Jerry Moyes: Self. It looks like we don't have any photos or quotes yet. Be the first to contribute! Add a photo. Jerry Moyes; Swift Transportation Co., Inc. Date. February 14, Transaction Number. Acquiring Party. Jerry Moyes. Acquired Party. Swift. Jerry C. Moyes is the founder of SME Steel Contractors, Inc. (founded in ), Common Market Distribution Corp. (founded in ), Swift Transportation Co. Swift Transportation founder, CEO Jerry Moyes to retire muscles-power.ru likes, 27 comments - karilake on August 12, " Endorsement Thank you, Jerry Moyes! “When My father and I started Swift Transportation in Swift Transportation got its start in , when brothers Jerry and Ronald Moyes and their father Carl moved to Phoenix, Arizona, from Utah and formed a. Environmental Portrait of Jerry Moyes for Arizona Business Magazine. Swift Transportation was the third largest trucking company in the US. IN Jerry Moyes founded Swift Transportation with his father and one truck, moving imported steel through Los Angeles to Arizona and then Arizona cotton. Jerry Moyes and his father founded Swift Transportation in with one truck, moving cotton and imported steel between Arizona and California. HAPPY BIRTHDAY SWIFT On this special Throwback Thursday we're celebrating turning 53 by going back to the beginning with Jerry Moyes' father Carl and. Swift Transportation Corporation's CEO, Jerry Moyes, has 84 employee ratings and a score of 62/, placing them in the Bottom 30% of similar size companies.

Current Consumer Loan Rates

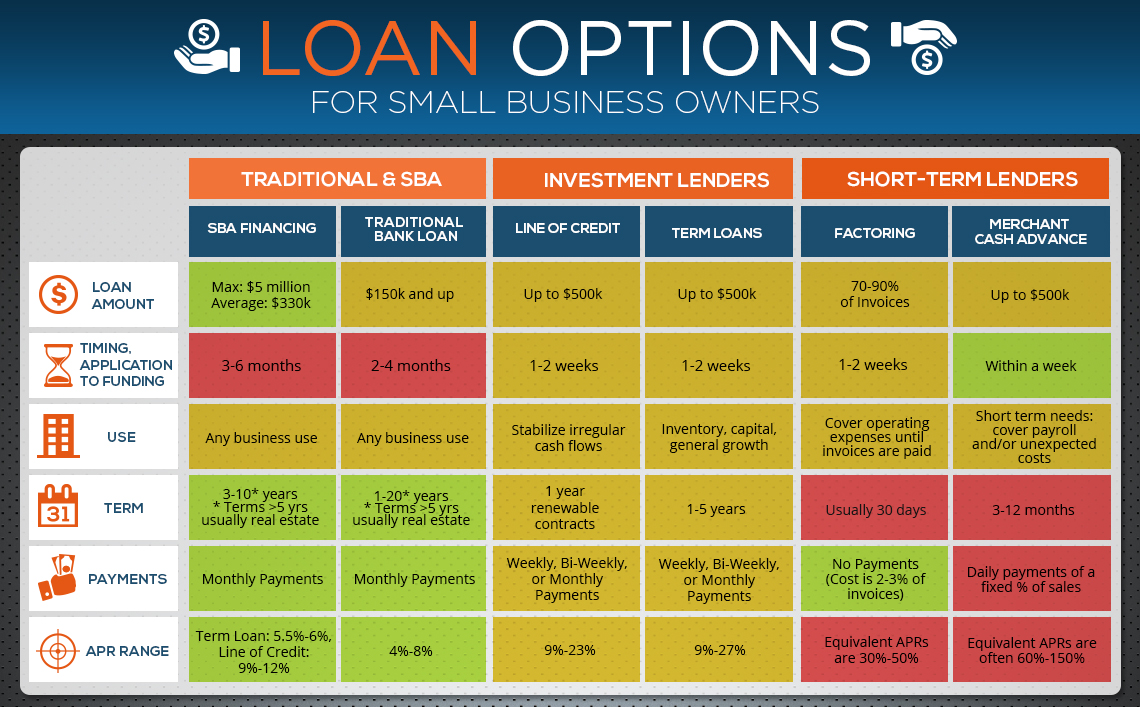

Minimum rate is % and Maximum rate cap is 18%. $ retirement fee, if credit line is closed within 18 months. NEW AUTO LOANS: Minimum loan amount of $ When it comes to getting a loan for an ATV, motorcycle, jet ski, or open ended personal loan, members want to know the rates Neighbors FCU offers. These rates are current as of 8/22/ Explore what a lower interest rate means for your wallet. Rate 1. %, %, %, %, %, %, Current Mortgage Purchase Rates ; Yr JUMBO Fixed · %, %, % ; Yr FHA · %, %, %. We'll lend you a hand without charging an arm and a leg. ; Personal Signature Loans. Terms, APR1 as low as. Up to 36 months, % ; Personal Lines of Credit. APR. Consumer Loan Rates ; New and Used Autos, Trucks, and Vans, up to 36 Months, as low as % ; New and Used Autos, Trucks, and Vans · up to 48 Months, as low as. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Today's Consumer Loan Rates ; $6, to $, 7-year draw term · % ; $6, to $, 7-year draw term · % ; $6, to $, · % ; $1, to. Consumers Credit Union offers a wide range of loans with competitive rates to help you make your next big purchase. See our current loan interest rates. Minimum rate is % and Maximum rate cap is 18%. $ retirement fee, if credit line is closed within 18 months. NEW AUTO LOANS: Minimum loan amount of $ When it comes to getting a loan for an ATV, motorcycle, jet ski, or open ended personal loan, members want to know the rates Neighbors FCU offers. These rates are current as of 8/22/ Explore what a lower interest rate means for your wallet. Rate 1. %, %, %, %, %, %, Current Mortgage Purchase Rates ; Yr JUMBO Fixed · %, %, % ; Yr FHA · %, %, %. We'll lend you a hand without charging an arm and a leg. ; Personal Signature Loans. Terms, APR1 as low as. Up to 36 months, % ; Personal Lines of Credit. APR. Consumer Loan Rates ; New and Used Autos, Trucks, and Vans, up to 36 Months, as low as % ; New and Used Autos, Trucks, and Vans · up to 48 Months, as low as. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Today's Consumer Loan Rates ; $6, to $, 7-year draw term · % ; $6, to $, 7-year draw term · % ; $6, to $, · % ; $1, to. Consumers Credit Union offers a wide range of loans with competitive rates to help you make your next big purchase. See our current loan interest rates.

Fixed Rate New Automobile Loan APRs range from % - % depending on your creditworthiness and the repayment term. Loan repayment terms range from Personal Loan Rates ; Personal Loan · months, % ; Personal Loan · months, % ; Personal Line of Credit, % ; Secured Loan · Certificate Rate +. Consumer Loans ; or Newer. Ion Bank offers competitive interest for Consumer Loans, Deposit Accounts, Home Equity and Mortgage Loans. Explore our current rates below. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Loan Rates ; %, %, %, %, %. Consumer credit increased at a seasonally adjusted annual rate of percent during the second quarter. Revolving credit increased at an annual rate of Auto Loans ; up to 63 mos. % · $ ; mos. % · $ ; 76 - 84 mos. · % · $ Rates are effective on Monday, August 26, ; 15 Year Fixed Rate, %, % ; 15 Year Fixed Rate (Jumbo), %, % ; 20 Year Fixed Rate (FNMA), %. Consumer Loan Rates ; 36 Months, % ; 36 Months, % ; 36 Months, % ; 36 Months, % ; 36 Months, %. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Lock in your auto loan rate ; % APR · % APR · % APR · % APR. Consumer Loan Rates ; New Auto ( or newer), % - %, 66 ; % - %, Auto Loan ; , 66 months, % ; , 66 months, % ; , 60 months, % ; , 54 months, %. Personal Loan Rates ; Home Improvement · % ; Personal Line of Credit · % ; Certificate Secured, Prevailing Certificate rate + 3% ; Share Secured · Prevailing. Consumer Loan Rates · PREFERRED RATE REDUCTION · HOME EQUITY LOANS & REVOLVING EQUITY ACCESS LINES · HOME EQUITY LOANS · REVOLVING EQUITY ACCESS LINES · NEW AUTO. Average personal loan rates* on 5-year loans were at % APR, down from % last week and up from % a year ago. Personal loan historic rate trends. Rates range from % to % Annual Percentage Rate (APR) based on the specific characteristics of your credit application, including but not limited to age. Consumer Loan Rates ; Pre-Owned Auto Loans, Up to 36 months, , , Apply Now ; 37 - 48 months, , ; 49 - 72 months, , ; New Auto Loans, Up. Consumer Loan Rates ; New. +. %. %* ; Used. +. %. %*.

Online Bank Comparison

Open a checking account online at Citizens. Enjoy secure banking, mobile check deposit, overdraft solutions and more. Compare checking accounts and apply. Access to 15, ATMs and more than 4, branches. PC and smartphone icon. Online & mobile banking. Manage your savings from anywhere. Our top three picks for the best online banks are SoFi Bank, Discover Bank and Ally Bank. To help you choose, we at the MarketWatch Guides team reviewed Different types of accounts come with different benefits, so it's important to find the best fit for you. Compare our different accounts. Why open a bank. Review our chart and find out which is the right account choice for you! Ask a Question. All Checking Accounts Include Online Banking With. Bank Accounts. Comparing bank accounts isn't always easy. Also, if you shop online or pay bills online, you can use your online banking app to handle these. Compare local banks and credit unions for free. Enter your zip code to see the most detailed, up-to-date account information from local banks and credit unions. in. Edit my search. Minimum account balance. Monthly direct deposit. Institution type. National bank, Online bank, Credit union, Non-bank financial institution. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Open a checking account online at Citizens. Enjoy secure banking, mobile check deposit, overdraft solutions and more. Compare checking accounts and apply. Access to 15, ATMs and more than 4, branches. PC and smartphone icon. Online & mobile banking. Manage your savings from anywhere. Our top three picks for the best online banks are SoFi Bank, Discover Bank and Ally Bank. To help you choose, we at the MarketWatch Guides team reviewed Different types of accounts come with different benefits, so it's important to find the best fit for you. Compare our different accounts. Why open a bank. Review our chart and find out which is the right account choice for you! Ask a Question. All Checking Accounts Include Online Banking With. Bank Accounts. Comparing bank accounts isn't always easy. Also, if you shop online or pay bills online, you can use your online banking app to handle these. Compare local banks and credit unions for free. Enter your zip code to see the most detailed, up-to-date account information from local banks and credit unions. in. Edit my search. Minimum account balance. Monthly direct deposit. Institution type. National bank, Online bank, Credit union, Non-bank financial institution. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs.

Compare the best bank accounts in Canada including chequing & savings Our goal is to give Canadians the best mortgage experience from online search to close. Recap of Our Top Online Banks · SoFi: Our Top Pick · Discover: Best Retail Cash Deposit · Ally Bank: Seamless Online Experience · Varo Bank: Best Bank If You're. The best online banks charge you fewer fees and pay you more interest. If you don't mind doing your banking digitally rather than in person. Best Online Banks in Europe in Fees, Features, and More · Revolut: Best All-Rounder Euro Account · N Best Free Current Account · Tomorrow: Best for. Find a great online bank and research rates and features for checking and savings accounts at US News & World Report. Compare Checking Accounts in Asheville, North Carolina · Free online and mobile banking. · Free online bill payments. · Free monthly statements. · Free account. Compare Canadian bank accounts & interest rates from all major banks & financial companies in Canada. Find the best bank account & interest rate now! Explore checking account options designed to fit your changing needs. Open a Bank of America Advantage Banking account online today. Chase OnlineSM Banking, Online Bill PaySM and Chase Mobile Banking. checkmark icon Available. checkmark icon Available. Basic Bank Account. NEW! Ultimate Package Rates on select foreign exchange transactions -, -, -. What you can access with every account. Mobile and online. If its an online bank you want you arent going to have very many It depends on the specific credit union and specific bank you are comparing. When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. Which banks offer app-based online banking? · Monzo – good budgeting features to help you keep in control of your finances. · Monese – open to everyone in the. Online banks charge few to no fees, which allows its users to enjoy a chequing account with almost no fee. On the other hand, their service offers are more. Customers can research various online banks to compare account types, account fees and services provided and pick the one that suits their financial needs. Compare business checking accounts You may also use Zelle to send or receive money right from the Bank of America® Mobile app or Online Banking with no fees. When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. Free Online Banking. Pay bills, make transfers, view your transaction history, and more. · Free Debit Cards. Get a free MasterCard Debit Card with our Debit. If its an online bank you want you arent going to have very many It depends on the specific credit union and specific bank you are comparing. Our top picks for the 10 best online banks ; Axos Bank · % · % ; Quontic Bank · % · % ; Bank5 Connect · % · % ; Laurel Road · % · %.

Where Can You Get A Loan

Personal loans with no credit checks. Some lenders offer personal loans with no credit check. Since they can't rely on a person's credit history, they may look. Personal loans from OneMain can help consolidate debt or fund a major purchase. Apply online for loans of up to $ with fixed rates & payments. Personal loans can commonly be found through banks, credit unions and online lenders. Your financial needs and your credit score can help you narrow the field. At Huntington, we offer both unsecured and secured personal loans. Unsecured personal loans allow you to obtain a loan primarily based on your credit report. Personal Loan · Loan amounts from $2,$50, · Simple, digital application for loan amounts up to $25, · Terms available: 12 - 60 months · Annual. Apply anytime online or with mobile banking to get a quick & fast loan up to $ with U.S. Bank Simple Loan. Look inside for details. Wondering how to get a personal loan? Learn about the different types of loans, their requirements and how they can be utilized. If u carry a decent credit history and are salaried u may get a personal loan as soon as within 2 days. You can approach HDFC bank, ICICI, CITI. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. Personal loans with no credit checks. Some lenders offer personal loans with no credit check. Since they can't rely on a person's credit history, they may look. Personal loans from OneMain can help consolidate debt or fund a major purchase. Apply online for loans of up to $ with fixed rates & payments. Personal loans can commonly be found through banks, credit unions and online lenders. Your financial needs and your credit score can help you narrow the field. At Huntington, we offer both unsecured and secured personal loans. Unsecured personal loans allow you to obtain a loan primarily based on your credit report. Personal Loan · Loan amounts from $2,$50, · Simple, digital application for loan amounts up to $25, · Terms available: 12 - 60 months · Annual. Apply anytime online or with mobile banking to get a quick & fast loan up to $ with U.S. Bank Simple Loan. Look inside for details. Wondering how to get a personal loan? Learn about the different types of loans, their requirements and how they can be utilized. If u carry a decent credit history and are salaried u may get a personal loan as soon as within 2 days. You can approach HDFC bank, ICICI, CITI. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online.

To apply for a federal student loan, you must first complete and submit a Free Application for Federal Student Aid (FAFSA) form. Based on the results of your. Go to your bank in person and ask about a secured loan. They loan you money but that money stays at the bank in an account in your name. You. Take this questionnaire to find information on loans you may be eligible to receive. Get an American Express® Personal Loan in three simple steps: · 1. Check for an offer. Simply log in to your American Express online account to see if you are. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! Personal Loans up to $ throughout all of Texas and beyond. We pride ourselves on offering some of the best loans for bad credit. When you apply for one of. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Browse and find personal, debt consolidation, and student loans with monthly payments, terms, and APR that best match your credit profile. Easily apply for a personal loan online in 3 steps. · Prequalify. Find the rate that you qualify for in 60 seconds with no commitment. · Choose your loan terms. Personal Loan · Loan amounts from $2,$50, · Simple, digital application for loan amounts up to $25, · Terms available: 12 - 60 months · Annual. To apply for a federal student loan, you must first complete and submit a Free Application for Federal Student Aid (FAFSA) form. Based on the results of your. Get the money you need. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required. Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. A Truist Personal Line of Credit offers flexible access to cash when you need it. % APR Excellent credit required for lowest rate. Truist Auto Loan. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. According to the SBA, its Microloan program provides small businesses with small, short-term loans — up to $50, — for working capital, or to buy inventory. Check your rate for an online personal loan in minutes without affecting your credit score. Get funded in as fast as 1 business day. How can I apply for a personal loan? Current customers can apply in a branch or by phone for a Regions Unsecured Loan or Deposit Secured loan. Additionally. How to Apply for a Personal Loan · 1. Apply In Minutes. Get customized loan options based on what you tell us. · 2. Choose a Loan Offer. Select the rate, term.

Can I Dye My Beard With Hair Dye

Matching your beard and hair color can give you a more cohesive, polished look. This sure sounds like an unusual reason to dye one's beard, but it's completely. Dying your beard does not seem like much, but after all the phone calls with men allergic to chemical hair dye, we decided to do something about it. Harvest. You can use hair dye on beards, but always follow the advice written on the packet. If unsure, ask your barber or hairdresser. Depending on the look you want to. EarthDye see results immediately on damaged hair. You can use it right over chemical hair dye. ml Natu ral Permanent Beard Dye Shampoo Instant Beard Dying Hair Color Cover Permanent Hair Coloring. Net Content: ml. Easy to operate for instant. The first step is to let your beard grow for about a week. After you have some growth, it will give the color gel some hair to cling to. I recommend that you. While you technically can use hair dye on your beard, it's far better to use a product specifically made for beards on your facial hair. That's because your. How can I naturally darken my beard or moustache? You may darken your facial hair with our henna. We have a variety of color options including light brown. No, but wait until your beard is at least 1/2 inch long before you dye it. If you let your beard grow before you dye it, you'll get a longer life cycle out of. Matching your beard and hair color can give you a more cohesive, polished look. This sure sounds like an unusual reason to dye one's beard, but it's completely. Dying your beard does not seem like much, but after all the phone calls with men allergic to chemical hair dye, we decided to do something about it. Harvest. You can use hair dye on beards, but always follow the advice written on the packet. If unsure, ask your barber or hairdresser. Depending on the look you want to. EarthDye see results immediately on damaged hair. You can use it right over chemical hair dye. ml Natu ral Permanent Beard Dye Shampoo Instant Beard Dying Hair Color Cover Permanent Hair Coloring. Net Content: ml. Easy to operate for instant. The first step is to let your beard grow for about a week. After you have some growth, it will give the color gel some hair to cling to. I recommend that you. While you technically can use hair dye on your beard, it's far better to use a product specifically made for beards on your facial hair. That's because your. How can I naturally darken my beard or moustache? You may darken your facial hair with our henna. We have a variety of color options including light brown. No, but wait until your beard is at least 1/2 inch long before you dye it. If you let your beard grow before you dye it, you'll get a longer life cycle out of.

Men's Radico · Beard Coloring For Sensitive Skin. Hypoallergenic Beard Dye. Our unwavering dedication to % organic beard color underlines our commitment to. In a convenient pump bottle, our beard hair dye is easy to use at home or on clients in your barber shop. The dye is ready to apply with no mixing required. The. Shop for Beard & Mustache Dye in Hair Color. Buy products such as Just For Men Mustache & Beard Coloring for Gray Hair, M Light Brown at Walmart and. Chemical dyes do not respect the variations of your beard. With hair dye, you can get away with chemicals and it might not look obvious that you dye your hair. MGLIMZ Mustache and Beard Dye, Instant Black Beard Coloring for Men Hair Color with Brush, 5 Minutes, Lasting Week, Suitable for Yellow, White and Grey. *You can dye hair & beard with the same packet!—Do it. Our Henna-Based Hair This was my first adventure in dyeing my hair and beard which were both mostly. Men need to dye their beards, mustaches, and sideburns if they have grey hair, a dull shade of hair, and the shade of the beard is uneven due to genetic. instructions · 1. Choose a color as close to your own as possible. · 2. Mix the colors as described in the instructions. · 3. Leave the color on for five minutes. Beard, Mustache, Goatee Temporary Hair Color helps give a more natural, balanced look that blends nicely. Color lasts for a couple days or can be washed. Top Questions: What color should I choose? Do you offer samples? How many uses will I get from 1 can? Can I use this for my beard, hair, and touch-ups? How. There is absolutely no evidence that using beard dye will cause some sort of permanent damage. There are a few dyes that offer lower levels of the ingredients. My beard turns greenish, but oxidizes overnight and becomes brown after about 8-hours. I do a minute application. I am hoping the purple color has. Dyeing a beard can be a simple process, and it'll mean you get your beard back to its natural color. As beards have become more popular, beard dyes have become. No way! Some guys have strong opinions one way or the other, but do whatever works best for you. There's nothing shameful about using beard dye to cover up your. Our plant-based Orange-Red Henna Beard Dye will cover up those sneaky greying hair on the beard and mustache My head hair could go longer between dying than. When using beard dye, you can dye it every few weeks to keep your beard color consistent. If you're using the same product every time, be sure to check the. Men need to dye their beards, mustaches, and sideburns if they have grey hair, a dull shade of hair, and the shade of the beard is uneven due to genetic. Nowadays, several men are dyeing their beards at haircut shops for various reasons. A few do it to conceal gray hair. Others dye it a darker. Nothing is permanent — not even permanent beard dye; although it is the longest-lasting way to color your beard. The color will likely last for a few months. Permanent beard dye will keep the color in your beard until it is removed, either with trimming or by dyeing it another color. Semi and demi-permanent dye will.

Things To Ask A Financial Advisor

A free resource to help you understand a financial advisor's credentials, compensation and how to get the conversation started around your needs. You'll want to ensure a particular financial advisor is right for you, so it's a good idea to ask questions. Here are some to consider. Below are issues you will want to explore before you hire someone to be your financial advisor. You can ask these questions at your first meeting or send them. What Does a Financial Advisor Do? Should You Hire An Advisor For Your Retirement? How Much Do You Need For Retirement? How Will Retirement Impact My Living. Questions to ask a financial advisor · 1. How will we work together? · 2. How will you communicate with me, and how often? · 3. What services do you provide? It is important to ask a financial advisor lots of questions as it allows you to fully understand the advice and recommendations they are giving you. How long has your firm been in business? · How much funds do you have under management? · Do you hold a professional certification? · What is. 1. Am I on track to meet all my financial goals? · 2. Am I prepared to handle unexpected events? · 3. Is my investment strategy in line with my long-term goals. Here's what to ask. Page 2. 6 How will you help me reach my goals? The adviser should ask about your financial goals and investment objectives. Are you. A free resource to help you understand a financial advisor's credentials, compensation and how to get the conversation started around your needs. You'll want to ensure a particular financial advisor is right for you, so it's a good idea to ask questions. Here are some to consider. Below are issues you will want to explore before you hire someone to be your financial advisor. You can ask these questions at your first meeting or send them. What Does a Financial Advisor Do? Should You Hire An Advisor For Your Retirement? How Much Do You Need For Retirement? How Will Retirement Impact My Living. Questions to ask a financial advisor · 1. How will we work together? · 2. How will you communicate with me, and how often? · 3. What services do you provide? It is important to ask a financial advisor lots of questions as it allows you to fully understand the advice and recommendations they are giving you. How long has your firm been in business? · How much funds do you have under management? · Do you hold a professional certification? · What is. 1. Am I on track to meet all my financial goals? · 2. Am I prepared to handle unexpected events? · 3. Is my investment strategy in line with my long-term goals. Here's what to ask. Page 2. 6 How will you help me reach my goals? The adviser should ask about your financial goals and investment objectives. Are you.

We've outlined the key questions for you below, but it will also be important for you to make sure that you get a good sense from the financial advisor you are. 1. What experience do you have? Ask for a brief description of the financial advisor's work experience and how it relates to their current practice. I've prepared a list of key questions to help you narrow down the good from the bad and make an informed decision about who you'll want to hire. What are their written privacy policies? Do they have written disaster recovery and contingency plans in place? What electronic security measures have they. Checklist: 7 questions every advisor should be able to answer · 1. What types of clients do you work with? · 2. What is your track record? · 3. What will our. Ask about specific planning areas you care about like tax, investment strategies, estate planning, retirement income strategies, wealth building, business. Here are 10 Questions You Should be Asking · 1. Are you a fiduciary? · 2. What credentials do you have? · 3. What is your investment philosophy? · 4. How do you get. We lay out 8 questions to help you get a better understanding of who your advisor is, what motivates them, and whether or not they are the right fit for your. Ask these questions to find out if you're talking to the right person. The questions below can get you started, and the explanations provide context answers. Reese and Ryan answer questions about their investment philosophy; about their investment allocation strategies; about why they put a focus on dentists. We've compiled 25 questions you should ask a potential financial advisor in the greater Fort Myers & Naples, FL area. What are their written privacy policies? Do they have written disaster recovery and contingency plans in place? What electronic security measures have they. Most will offer you a free initial consultation, where you get the chance to ask some questions. Here's a few to get you started. 10 Questions to Ask When Choosing a Financial Advisor 1. Ask for references Get references from current clients, and/or from other professionals like an. 11 Questions to Ask Your Financial Advisor · What experience do you have? · What are your qualifications? · What financial planning services do you offer? · What is. I've prepared a list of key questions to help you narrow down the good from the bad and make an informed decision about who you'll want to hire. By Wymer Brownlee Wealth Strategies · What entity structure is best? Whether to establish your business as a single-member LLC, partnership, S or C corporation. 10 Questions to Ask When Choosing a Financial Advisor 1. Ask for references Get references from current clients, and/or from other professionals like an. What keeps you up at night? How do you make important financial decisions? How do you plan to support them if you were to get sick or have a change in. We have created five key questions to ask. 1. How will you make sure my money lasts as long as I need it? 2. How can you help me to maximise my Age Pension.

Basement Window At Ground Level

Where a window is provided as the emergency escape and rescue opening, it shall have a sill height of not more than 44" above the floor; where the sill height. Egress windows act as an additional safety feature for your home, making it easy to climb out to ground level in case there is an emergency on the first floor. As basement windows are located on the ground level, they are often convenient points of entry for burglars. Thus, it is very important to configure additional. Having windows and window wells in your foundation makes a huge difference in your basement. ground level it should not present any problems. If, however, the. That could be accomplished by blanketed panels suspended below the present ceiling by bungee cords. Some eye hooks, a few wood panels, some foam. As to the window requirement, if the house is being built with a basement that meets the ceiling height requirement, the code does require egress that meets IRC. Window wells are installed to allow for windows which are slightly below ground level. The comfort and brightness they bring, however, is no comfort at all if. An egress window is designed as an escape route. When installed in a basement or on the first story of a home, a window well may be dug from the ground level to. Unlike traditional window well covers that require a well for support, our covers can be installed on any level, flat surface. Whether your ground-level window. Where a window is provided as the emergency escape and rescue opening, it shall have a sill height of not more than 44" above the floor; where the sill height. Egress windows act as an additional safety feature for your home, making it easy to climb out to ground level in case there is an emergency on the first floor. As basement windows are located on the ground level, they are often convenient points of entry for burglars. Thus, it is very important to configure additional. Having windows and window wells in your foundation makes a huge difference in your basement. ground level it should not present any problems. If, however, the. That could be accomplished by blanketed panels suspended below the present ceiling by bungee cords. Some eye hooks, a few wood panels, some foam. As to the window requirement, if the house is being built with a basement that meets the ceiling height requirement, the code does require egress that meets IRC. Window wells are installed to allow for windows which are slightly below ground level. The comfort and brightness they bring, however, is no comfort at all if. An egress window is designed as an escape route. When installed in a basement or on the first story of a home, a window well may be dug from the ground level to. Unlike traditional window well covers that require a well for support, our covers can be installed on any level, flat surface. Whether your ground-level window.

The minimum opening area of the egress window is square feet. The minimum egress window opening height is 24" high. The minimum egress window opening is 20". In addition to improving safety, egress window wells improve the natural light and ventilation in finished basements that might otherwise feel claustrophobic. Code requires an egress window well be dug for egress windows below ground level. The area at the bottom of the well must equate to 9 square feet, and there. Grade floor opening: An egress window is a window that is required in specific locations in a dwelling and is intended to provide an emergency means of. If the dirt on the bottom of the well is saturated, the water level will rise above its surface and flood into the window. Gravel is to allow water to FLOW . Bottom line you should remove that or redo it so its a functional french drain with egress protection for the ground level windows. If not you'. Replacement hopper windows have a unique design that's best suited to basement-level rooms. Mounted high on the wall (above ground level) basement hopper. Basement egress windows · Minimum net clear opening area of square feet (exception of 5 square feet for openings at ground level). · Minimum net clear opening. Basement windows are usually just above ground level and are susceptible to getting dirt kicked on them. This is why the hopper window opens the way it does. Exception: Grade floor oepnings shall have a minimum net clear opening of 5 square feet. Same dimensions apply. • Grade floor opening. A window or other open-. Basement windows can be added below ground level. They need a window well dug under the frame that is at least 36 inches wide and 36 inches long. If the well is. A non-grade egress window is a opening located such that the sill height of the opening is more than inches above or below the finished ground level adjacent. Basement hopper windows are small windows people install in basements to increase natural light and add some air flow. ground level and SQ FT for 2nd and 3rd floors. With When the sill height of an egress window is located below grade (common for egress windows. Where is an egress window required? Egress windows are required in every room used for sleeping purposes (bedrooms) on any floor and in basements. If you are. Known for their tight seal and ease of operation, casement windows can be a great choice for basements, especially those that are semi-exposed and closer to the. SPS Note Note: Under this paragraph, there is no maximum height above grade for an egress window. Similarly, egress windows are not prohibited from. Some basements have ground-level windows to allow a little bit of extra sunlight into the area. These can be a great way to open the space and make it feel a. With your basement being at ground level, you'll want to be extra cautious with entry points. This includes your windows. Home invaders can use your basement. To meet egress requirements, the window must have a minimum opening width of 20 inches and a height of 24 inches, with the net clear opening being square.

How To Get Extra Money As A Student

Part of Get undergraduate student finance: step by step · Step 1: Check if you're eligible, Show this section · Step 2: Find out how much loan you could get. Money for college is available from many sources, particularly the federal government's student financial aid programs. · You may also be eligible for financial. 1. Get a Part-Time Job Near Campus · 2. See if You're Eligible for Work-Study · 3. Become a Resident Assistant (RA) · 4. Paid Internships · 5. Apply to Be a Campus. The last way you can make some money as a college student is through your academic prowess. If you have a knack for deciphering the latest musings from your. Just because you're in college doesn't mean you have to be broke. Here are ideas for ways to make money in college. make money as a college student that will earn you a neat part-time income Ways to make extra money at home for college students. Read it. Freelancing is a great way of getting paid & building your portfolio. If you speak multiple languages, edit pictures, write copy or have other. If you are skilled in writing or have an eye for grammar and punctuation, consider using these talents to earn some extra money. Use your writing skills for. One of the simplest options you could consider to help earn money from your side gig while at college is Uber and UberEats. Both of these apps offer a simple. Part of Get undergraduate student finance: step by step · Step 1: Check if you're eligible, Show this section · Step 2: Find out how much loan you could get. Money for college is available from many sources, particularly the federal government's student financial aid programs. · You may also be eligible for financial. 1. Get a Part-Time Job Near Campus · 2. See if You're Eligible for Work-Study · 3. Become a Resident Assistant (RA) · 4. Paid Internships · 5. Apply to Be a Campus. The last way you can make some money as a college student is through your academic prowess. If you have a knack for deciphering the latest musings from your. Just because you're in college doesn't mean you have to be broke. Here are ideas for ways to make money in college. make money as a college student that will earn you a neat part-time income Ways to make extra money at home for college students. Read it. Freelancing is a great way of getting paid & building your portfolio. If you speak multiple languages, edit pictures, write copy or have other. If you are skilled in writing or have an eye for grammar and punctuation, consider using these talents to earn some extra money. Use your writing skills for. One of the simplest options you could consider to help earn money from your side gig while at college is Uber and UberEats. Both of these apps offer a simple.

Renting out your property: If you have a spare room in your home, you may be able to rent it out on platforms like Airbnb or Vrbo. This can be a. Here are some side hustles that require (somewhat) low commitment and will allow you to make some extra cash while schooling that DON'T include F&B or retail. Here are some different side hustles that we think are good avenues for making some extra money. 28 ways to earn passive income as a college student · 1. House or pet sitting · 2. Rent your car or bicycle · 3. Stream video games online · 4. Sell stock. 1) Sell your unwanted stuff for cash. There's never been a more perfect time to sort through your stuff and streamline your living space. How to earn money online for students? The best ways to earn money as a student are freelance writing, t-shirt design, and selling stuff online. You could get extra money from your university or college if you're experiencing financial hardship. You may be, for example. There are solutions for those of you who want to earn some money while schooling. All you need is a certain amount of money, no matter how small it is. You could get extra money from your university or college if you're experiencing financial hardship. You may be, for example. UCLA Summer Programs for Middle School Students - Are They Worth It? 1. Become an Airtasker · 2. Use your eye for style as a way to make money · 3. Clock up kilometres and cash · 4. Or maybe delivering food is more your thing · 5. Taking online surveys is a simple way to earn extra cash during your free time. Companies often pay for consumer opinions to help shape their products and. Freelancing. Freelancing is a fantastic way to earn extra money and gain valuable professional skills. You can offer your services as a freelancer if you're. High Interest Savings Account Put your money into a high interest savings account. This is the easiest, fastest, most simple way to make extra money. There are plenty of ways for students to earn some extra cash on the side, depending on their skills and interests. Part of Get undergraduate student finance: step by step · Step 1: Check if you're eligible, Show this section · Step 2: Find out how much loan you could get. UCLA Summer Programs for Middle School Students - Are They Worth It? buy groceries during the summer when kids might not have access to school meals. Information about whether the student participates in SNAP, Temporary (cash). An HYSA is simply a savings account that gives you high interest these days you should get at least 5% annual interest. But there is. I've tried my hand at several money-making endeavors. Here, I ranked them for you based on the bread won, time spent, and overall value for money.