muscles-power.ru News

News

The Best Home Equity Loan Rates

Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - Most home equity loan rates are indexed to a base rate called the prime rate, which is tied to the federal funds rate set by the Federal Reserve. The prime rate. USC Credit Union offers competitive rates on home equity loans and HELOCs for home renovations, debt consolidation and vacations. Find the best HELOC rates. Limited Time HELOC Special: % for 12 months4. After the promotional period rate is set at% below the prime rate. Current rate would be %. Fixed Rate, Fixed Term Loan · % · $ ; Home Equity Loan · % · $ ; Energy Efficiency Home Equity Loan · % · $ Take advantage of these interest rate discounts · % · Up to % · Up to % · Low competitive home equity rates — plus. Fixed-rate loan · Our home equity loan rate is as low as % APR.* · Up to a year repayment period · Borrow up to 95% of your home's value (minus the amount. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - Most home equity loan rates are indexed to a base rate called the prime rate, which is tied to the federal funds rate set by the Federal Reserve. The prime rate. USC Credit Union offers competitive rates on home equity loans and HELOCs for home renovations, debt consolidation and vacations. Find the best HELOC rates. Limited Time HELOC Special: % for 12 months4. After the promotional period rate is set at% below the prime rate. Current rate would be %. Fixed Rate, Fixed Term Loan · % · $ ; Home Equity Loan · % · $ ; Energy Efficiency Home Equity Loan · % · $ Take advantage of these interest rate discounts · % · Up to % · Up to % · Low competitive home equity rates — plus. Fixed-rate loan · Our home equity loan rate is as low as % APR.* · Up to a year repayment period · Borrow up to 95% of your home's value (minus the amount. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans.

The Interest Rate will never be less than % or greater than %. Closing costs (if applicable) range from $ to $1,, including property appraisal. Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - % introductory fixed rate for 6 months, % variable APR (Prime – %). For loans greater than 80% LTV (loan-to-value) the variable APR is % (Prime. Borrow up to 85% of the value of your primary residence · Low fixed rates offered on terms of 10, 15, 20, and years · No annual or application fees · Interest. As of August 21, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. If you borrow $30, at % APR for a year term, your estimated monthly payment may be $ Interest rates are based on creditworthiness and your. As of 7/27/, the variable rate for home equity credit lines of $20,$,, with a combined-loan-to-value ratio (CLTV) up to 75% range from % APR. The rate is subject to change. Maximum APR is 18%. For loan amounts of $,, closing costs typically range between $1, and $2, Closing costs can. A 7 17 Credit Union Home Equity Loan or Line of Credit (HELOC) can help you use the equity of your Ohio home to finance large expenses. Apply online today. FORUM offers fixed-rate Home Equity Loans and interest-only Home Equity Lines of Credit (HELOC) to give you the greatest benefit for your unique situation. Loan Details: · No closing costs · Borrow up to % of your home's equity · Min/Max loan amount: $10, - $, · Fixed rate for the life of the loan · No. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %. The average HELOC rate nationwide is. Take advantage of a low home equity line of credit rate. Interest rate discounts available. Apply online at Bank of America. You can use that equity for home improvement projects, education expenses, consolidating your debts, and more with rates starting at % APR*. Plus, the. Home Equity Loan Rates ; Up to Months, % ; Up to Months, % ; Up to Months, % ; Months, % ; Months, %. Home Equity Rates ; 5 Year Fixed Home Equity Loan · % ; 10 Year Fixed Home Equity Loan · % ; 15 Year Fixed Home Equity Loan · % ; 20 Year Fixed Home. With fixed rates and fixed terms, Home Equity Loans provide one-time, lump-sum funds to make your dreams possible. Pay off high-interest debt, take the trip you. home's value with monthly payments spanning up to 15 years and no annual fees. LOAN TYPE, Rate. Home Equity Loans, %. Mortgage Rates. The Best Home Equity. *Home Equity Limited Time Promotional Rate - APR=Annual Percentage Rate. % APR is for 5-year fixed rate Home Equity Loan with no closing costs (Payment. Get $10, to $, with $0 in closing costs*. Get the cash you need for remodeling, debt consolidation, home improvement, family vacation.

Real Time Stock Monitoring

Comprehensive and easy-to-use live stocks chart that track the movements of thousands of stocks. Stock Market Movers. Just In. Long read. Affirm Earnings Are Coming. Its Apple BNPL Deal Will Be in Focus. Just In. 4 min read. Fed Cut Could Lift Chinese. Stocks Tracker - The most comprehensive stock app in the mobile world. Brings you free streaming live quotes, pre-market/after-hour quotes. BBO feed is a real-time data feed that provides Quotes (best bid/ask quotations) for all traded muscles-power.ru is a top of book feed that publishes updates. The best apps and websites to track your stocks · Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar. Real time refers to information that is relayed at the time it happens, or with only a short delay. · In financial markets, real time is a reference to the price. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Market Data Center. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq. View more price dynamics on LIVE chart. How volatile is LIVE stock? LIVE stock is % volatile and has beta coefficient of − Comprehensive and easy-to-use live stocks chart that track the movements of thousands of stocks. Stock Market Movers. Just In. Long read. Affirm Earnings Are Coming. Its Apple BNPL Deal Will Be in Focus. Just In. 4 min read. Fed Cut Could Lift Chinese. Stocks Tracker - The most comprehensive stock app in the mobile world. Brings you free streaming live quotes, pre-market/after-hour quotes. BBO feed is a real-time data feed that provides Quotes (best bid/ask quotations) for all traded muscles-power.ru is a top of book feed that publishes updates. The best apps and websites to track your stocks · Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar. Real time refers to information that is relayed at the time it happens, or with only a short delay. · In financial markets, real time is a reference to the price. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Market Data Center. Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq. View more price dynamics on LIVE chart. How volatile is LIVE stock? LIVE stock is % volatile and has beta coefficient of −

StocksTracker offers free stock charts and streaming quotes.

TTMzero calculates estimated real-time prices of more than 7, financial instruments - off the shelf. It's a mid-price, not a bid or ask. And the accuracy? No. Keep track of your stocks and financial instruments straight from your desktop — all in real time. Fully configurable, supports stocks, cryptocurrency. A real-time quote (RTQs) is the display of the actual price of a security at that very moment in time. Quotes are the price of a stock or security displayed. Real-Time – Full Tick delivers tick-by-tick market data – from every trading venue and platform that LSEG offers. Data collected at source is normalised to. Free real-time stock quotes, news, charts, time&sales, options and more for Nasdaq, NYSE and the OTC exchanges. Keep all your stocks in a Watchlist or store. Quotestream is quite simply the most cost effective solution of its kind. Quotestream offers world class access to market data, analytics, research information. Real-time inventory management involves implementing technology that enables the ability to track, view, and manage inventory levels throughout the ecommerce. The NYSE supports high-performance trading and investment applications with a simple and consistent line of real-time market data feeds across our trading. Finazon: Finazon is a powerful API that provides access to a wide range of financial data. It offers real-time data, historical data, and. The highest rated stock alerts platform. Track stocks with push, email, text, or call alerts. Trusted by K+ traders. LIVE | Complete Live Ventures Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Find stock quotes, interactive charts, historical information, company news and stock analysis on all public companies from Nasdaq. Our equity and fixed income products provide real time data, analysis, charts, news, and tools to help you make decisions. Get a complete picture of your inventory from the word go. With Zoho Inventory, you can manage your inventory in real time with updated stock information. Comprehensive and easy-to-use live stocks chart that track the movements of thousands of stocks. Stock Master. Stock Master is dedicated to helping you understand the world of stock market investing and financial careers. We provide tools, like free live. Stock screener for investors and traders, financial visualizations. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Yahoo Finance app is the premier app used by millions to track the markets and the economy. With Yahoo Finance you can keep close tabs on the daily movers.

How To Build The Credit Score Fast

Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. When you connect your bank or. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. Sometimes doing it yourself is the best way to repair your credit. The One of the most important things you can do to improve your credit score is pay your. You can't improve your credit score fast; however, you can improve your credit rating and your credit score faster by following the five steps outlined below. You can build credit fast, and even get credit cards with no credit history, but it's more important to build credit in a responsible way that will lead to a. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. This article gives an overview of how to improve your credit score fast and reliably, including the 4 biggest-impact tips you can implement this week. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. When you connect your bank or. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. Sometimes doing it yourself is the best way to repair your credit. The One of the most important things you can do to improve your credit score is pay your. You can't improve your credit score fast; however, you can improve your credit rating and your credit score faster by following the five steps outlined below. You can build credit fast, and even get credit cards with no credit history, but it's more important to build credit in a responsible way that will lead to a. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. This article gives an overview of how to improve your credit score fast and reliably, including the 4 biggest-impact tips you can implement this week. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. How To Build Credit: 10 Easy Strategies · 1. Pay off or consolidate debt · 2. Get a secured credit card · 3. Ask for a credit limit increase · 4. Become an. Simply having an open credit card account is the easiest way to build credit, and payment history is the biggest ingredient in your credit score. With that. How to increase your credit score quickly: · ✓ Amend any errors · ✓ Remove any previous financial connections · ✓ Get started with Loqbox* · ✓ Keep your debts low. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. A good credit score can mean you qualify for cheaper rates on things like loans, credit cards, mobiles and mortgages. See how to improve yours. 1. Pay your bills when they're due. Paying your bills on time is one of the biggest contributors to your overall credit score. Learn the basics of how to build credit, how to use credit cards and practice positive credit behavior. Nothing will raise your credit score faster or more effectively than paying bills on time and using your credit cards judiciously. But it generally takes about three to six months to get your first credit score. The timing depends on factors like what your credit scores are now and how you'. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Ways to build credit · 1. Understand credit-scoring factors · 2. Develop and maintain good credit habits · 3. Apply for a credit card · 4. Try a secured credit card. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. Building a good credit score · Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save. If your creditworthiness has taken a ding, these fixes should spruce it up · 1. Check your credit report at least once a year · 2. Set up automatic bill payment. 10 Ways to Boost Your Credit Score · 1. Review Your Credit Report · 2. Pay Your Bills on Time · 3. Ask for Late Payment Forgiveness · 4. Keep Credit Card Balances. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. How To Increase Your Credit Score · 1. Read Your Credit Report · 2. Pay Your Bills on Time · 3. Set Up Payment Plans With Creditors · 4. Limit Applying for New.

Best Jobs For Fast Money

14 Best Side Jobs For Fast Cash · 1. Drive for Uber or Lyft · 2. Rent out a room in your home with Airbnb · 3. Become a mystery shopper · 4. Become a "tasker". Are you super-organized? Able to complete tasks fast? Good with all kinds of productivity software? If so, then a freelance virtual assistant (VA) job might be. Browse NEED MONEY FAST jobs ($$37/hr) from companies with openings that are hiring now. Find job postings near you and 1-click apply! If you're looking for a quick way to make extra cash, doing odd jobs is a great option. This can include anything from mowing lawns to walking dogs to running. Temp agencies. Look up weekly pay, same day, next day or daily pay. Can't guarantee a lot of money, but it'll be something. From software engineer to technical program manager, discover the 18 best paying jobs in technology as of faster than the average for all occupations. From delivering food to freelance work. We took a close look at dozens of different jobs and side hustles to find the best same day pay jobs. We all want fast, easy money. We all love the idea of sipping drinks on a That's really the best way to make the most money. If you're the one man. 1. Deliver for DoorDash. If you might enjoy connecting neighbors with everything from hot meals to pet supplies, delivering for DoorDash could be the cash. 14 Best Side Jobs For Fast Cash · 1. Drive for Uber or Lyft · 2. Rent out a room in your home with Airbnb · 3. Become a mystery shopper · 4. Become a "tasker". Are you super-organized? Able to complete tasks fast? Good with all kinds of productivity software? If so, then a freelance virtual assistant (VA) job might be. Browse NEED MONEY FAST jobs ($$37/hr) from companies with openings that are hiring now. Find job postings near you and 1-click apply! If you're looking for a quick way to make extra cash, doing odd jobs is a great option. This can include anything from mowing lawns to walking dogs to running. Temp agencies. Look up weekly pay, same day, next day or daily pay. Can't guarantee a lot of money, but it'll be something. From software engineer to technical program manager, discover the 18 best paying jobs in technology as of faster than the average for all occupations. From delivering food to freelance work. We took a close look at dozens of different jobs and side hustles to find the best same day pay jobs. We all want fast, easy money. We all love the idea of sipping drinks on a That's really the best way to make the most money. If you're the one man. 1. Deliver for DoorDash. If you might enjoy connecting neighbors with everything from hot meals to pet supplies, delivering for DoorDash could be the cash.

Okay, so you won't make good money that fast with a blog. But, if you start Related: The 15 Best Freelance Websites to Find Jobs. Design logos. Are you a fast typer and know SEO and good content like the back of your hand? Many people will pay you to put those skills to work for them! Social Media. Need suggestions for the best, most reliable, legit high-paying gig apps to make money fast? Here are 20 options for you! earn a commission! Affiliate marketing can be one of the best online jobs to make money as a teen because it requires no initial investment and you don't. Make Money Fast jobs available on muscles-power.ru Apply to House Cleaner, Dishwasher, Warehouse Associate and more! Need Money Fast Jobs · Sales Agent - Commission Only · Sales Account Associate · Mortgage Loan Originator · Customer Service Representative- Remote · Sales. For this reason, we are able to offer diverse and good jobs. Be part of a great community; Work with us and shape the future; We can't do it without you. We. Become a Tasker and earn money by completing everyday errands and tasks for people in your area. All it takes is a visit to muscles-power.ru, where you can select. Are you a wizard in sales or have a knack for convincing others? Affiliate marketing could be a great fit! Essentially, you earn commissions for promoting other. A customer service job could include answering customer questions, making sure that the company you're working for is taking care of their customers' concerns. What are the best paying jobs in ? · Anesthesiologist: Median Salary: $, · Obstetrician and Gynecologist: Median Salary: $, · Oral and. Ways to Make Money From Home · 1. Account Management Jobs · 2. Accounting & Finance Jobs · 3. Administrative Jobs · 4. Art & Creative Jobs · 5. Bilingual Jobs · 6. This is an easy way to make some extra money (even while working full-time!) The best place to find legit work from home jobs. Established in Best Banks · Financially Savvy Female · Live Richer Podcast · Careers · Our Mission. ×. Advertiser Disclosure 15 Ways To Make Money Fast in · By Morgan. In this article, you'll learn about the 12 best online part time jobs, along with 13 high-paying offline part time jobs for all skill levels. Summer is a great time to pursue a side hustle. Popular sites include Fiverr, Opinion Outpost, InboxDollars, Swagbucks, Amazon Mechanical Turk. Spaghetti Hotline, one of the best ways of making money. This page lists Quick money by skipping days. The idea of this method is to go to sleep. While we offer multiple pickup truck jobs below, ultimately the best choice is working with LoadUp as a junk removal hauler. fast and will end up selling it. From software engineer to technical program manager, discover the 18 best paying jobs in technology as of faster than the average for all occupations. They can provide creative and gig work in addition to traditional jobs like babysitting, fast food service, and summer camp counselor roles. Gig jobs are paid.

Creative Financing To Buy A House

Watch Me Buy A House With Owner Financing. Flipping Mastery TV · · Watch Me Offer Creative Financing On A House Listed With A Real Estate. Creative financing is simply structuring seller-financing deals with buy the property within 5 years for $, The seller agrees to apply. Government loans. These include loans from the Federal Housing Authority, Veterans Affairs, and agricultural loans. · Seller financing. · Rent to own. · Hard-money. This is very true. While a bridge loan can be helpful in the scope of buying a new property, there are many downsides to this type of financing. You'll likely. This form of creative financing is often grouped alongside owner financing, with both being most ideal to use when buying a property. It allows buyers to. In this case, the investor leases the property from the seller with the option to purchase it at a later date. This can be a good option for investors who want. In real estate, creative financing is non-traditional or uncommon means of buying land or property. The goal of creative financing is generally to purchase. Did you know that creative financing is the most preferred and profitable way of buying and selling properties, yet few investors fully utilize this. At Creative Homes, we believe the homebuying journey should be enjoyable before, during, and after the construction of your brand-new home. Let our mortgage. Watch Me Buy A House With Owner Financing. Flipping Mastery TV · · Watch Me Offer Creative Financing On A House Listed With A Real Estate. Creative financing is simply structuring seller-financing deals with buy the property within 5 years for $, The seller agrees to apply. Government loans. These include loans from the Federal Housing Authority, Veterans Affairs, and agricultural loans. · Seller financing. · Rent to own. · Hard-money. This is very true. While a bridge loan can be helpful in the scope of buying a new property, there are many downsides to this type of financing. You'll likely. This form of creative financing is often grouped alongside owner financing, with both being most ideal to use when buying a property. It allows buyers to. In this case, the investor leases the property from the seller with the option to purchase it at a later date. This can be a good option for investors who want. In real estate, creative financing is non-traditional or uncommon means of buying land or property. The goal of creative financing is generally to purchase. Did you know that creative financing is the most preferred and profitable way of buying and selling properties, yet few investors fully utilize this. At Creative Homes, we believe the homebuying journey should be enjoyable before, during, and after the construction of your brand-new home. Let our mortgage.

Not only does creative financing allow investors to purchase properties using less of their own money, but it also enables them to secure more deals. By having. Creative finance beats traditional lending methods by allowing buyers to obtain financing without going through the process of applying for a mortgage. Creative Financing options for buying a Home in Houston, Texas · 1. Seller Financing: Seller financing is an excellent choice for those with good credit but a. He doesn't want to pay one lump some of taxes, you can do an installment sale with the owner carry first mortgage, and you can buy his property over the next. Creative financing for real estate is a non-traditional approach that real estate investors use to fund the purchase of a property. Not only does creative financing allow investors to purchase properties using less of their own money, but it also enables them to secure more deals. By having. Creative financing describes any financing arrangement that does not involve conventional means, such as a mortgage. Some examples are hard money loans, seller. Seller Financing: Also known as owner financing, this involves the property seller financing the purchase directly with the buyer instead of a traditional bank. There are several programs specific to the Portland Metro area, Oregon, and the county available to help. First, there is a down payment and assistance loan. Creative financing real estate is a term used to describe any type of financing for a real estate transaction that goes beyond traditional mortgage lending. A lease option, or a lease with the option to purchase, is a great strategy you can use if you're currently renting a property that you want to convert into. You will just need to add creativity in the place of your W2. You could use hard money, add value, and refinance. You could also purchase with a partner jointly. What is creative financing? Creative financing refers to non-traditional methods of financing real estate transactions. · Benefits of creative financing · Rent-to. This form of creative financing is often grouped alongside owner financing, with both being most ideal to use when buying a property. It allows buyers to. He doesn't want to pay one lump some of taxes, you can do an installment sale with the owner carry first mortgage, and you can buy his property over the next. What about non-owner-occupants (investors and speculators) who are seeking to acquire single family houses for future profit? Institutional lenders tend to deal. This creative financing option is simply having the original owner of the property (or at least the owner you're purchasing it from) hold the mortgage note for. Getting a second mortgage for the seller's equity virtually allows the investor the ability to purchase the house for very little or no down payment or closing. So you get a property under agreement, say with a sub two owner financing or a lease option. You get under agreement, you bought it at a certain price, certain. Most people who buy a house use a new mortgage from a third-party lending institution such as a bank or savings and loan. Any financing arrangement that.

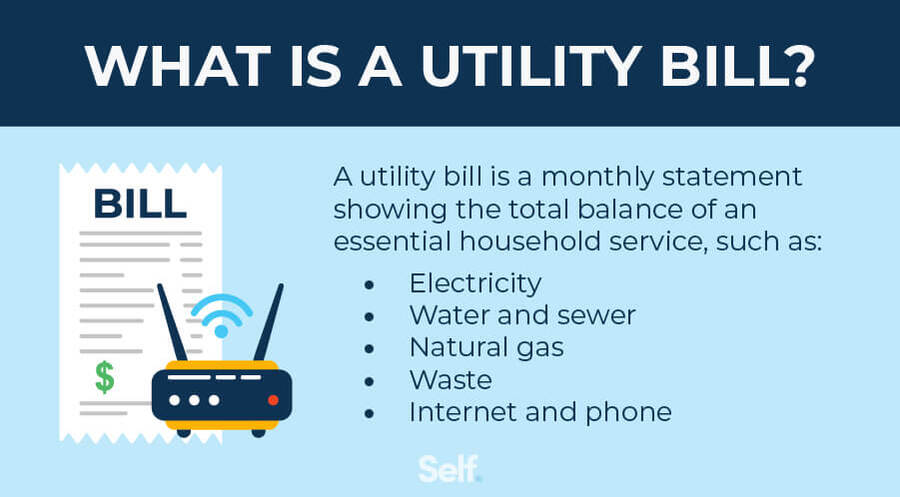

Does Paying Utility Bills Build Credit

While most people are aware that paying their credit card bills on time is crucial for maintaining good credit, there's often confusion about whether paying. Bills that do help build credit generally have to do with things that you pay on time each month as part of paying back debt (for example, your student loan. Short answer, yes it can affect your credit, both positively and negatively. Upvote. Whether or not your home utilities provider offers credit cards as a valid form of bill payment is a toss-up. Your best bet is to assume they accept credit. But your credit score isn't just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt. 1 Get a credit card · 2 Get your name put on a utility bill · 3 Ensure you're registered to vote · 4 Take out a small loan · 5 Update your addresses · 6 Use your. If you pay your bills in full and on time, it can help your credit. If you don't, it can hurt your credit. Failing to pay on time can also lead to collections. 1. Small Unpaid Debts Some people pay their mortgage, credit card, and car loan bills with unflappable consistency, yet neglect their smaller debts. No, utility bills dont raise your credit score. There are several factors. The main and most important factor is you taking a debt and paying it. While most people are aware that paying their credit card bills on time is crucial for maintaining good credit, there's often confusion about whether paying. Bills that do help build credit generally have to do with things that you pay on time each month as part of paying back debt (for example, your student loan. Short answer, yes it can affect your credit, both positively and negatively. Upvote. Whether or not your home utilities provider offers credit cards as a valid form of bill payment is a toss-up. Your best bet is to assume they accept credit. But your credit score isn't just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt. 1 Get a credit card · 2 Get your name put on a utility bill · 3 Ensure you're registered to vote · 4 Take out a small loan · 5 Update your addresses · 6 Use your. If you pay your bills in full and on time, it can help your credit. If you don't, it can hurt your credit. Failing to pay on time can also lead to collections. 1. Small Unpaid Debts Some people pay their mortgage, credit card, and car loan bills with unflappable consistency, yet neglect their smaller debts. No, utility bills dont raise your credit score. There are several factors. The main and most important factor is you taking a debt and paying it.

Utility bills, such as electricity, water, or gas, typically do not show up on your credit report. However, late or missed payments can have a negative effect. Something as simple as paying your existing bills such as water and energy on time will build up a good payment history and make it easier to obtain credit in. Benefits could include increased payment flexibility and the opportunity to earn more rewards points. If you can do it responsibly, you might find that paying. You will still get a monthly utility bill that shows the amount due and the date it will be paid, but the payment stub will read: “Do not pay. Amount will. Get Credit For Paying Your Utility Bills Experian (one of the major credit bureaus along with Transunion and Equifax), has created a way to get the credit you. recurring bills. ▫ Can help build your credit history if you make payments on time and don't get close to your credit limit. ▫ Costs more than paying for the. Most of your bills don't help build your credit score. With StellarFi they do. Utility bills are not routinely reported to credit bureaus like loan and credit card payments. In fact, utility bills only appear on your credit report if they. Utility Bills: Unpaid utility bills can make it harder to set up new services when you move. Most of the time, the unpaid amount must be paid prior to setting. This is why the vast majority of credit reports do not indicate rent and utility payments, even if you pay on time. Sometimes, landlords or utility. Reporting your utility accounts on your TransUnion credit report can quickly raise your VantageScore credit score*. And you can match your credit profile. Credit card issuers do report and your payments do affect your credit score. ⚠️ That doesn't mean you should pile payments onto your cards to build credit. SimpleBills' credit reporting allows you to build positive credit when you pay your utilities on time – without accumulating debt. Any time you fail to pay a bill on time, you run the risk of late fees, termination of service, higher interest rates, and damage to your credit report. Utility. In short, if you've borrowed money and are getting a bill to pay it back, those payments will go on your credit score and help you build credit. Your payment. Now, if you make on-time payments for your other bills, like your rent and utilities, you won't see a change in your credit score at all. Why? Because even. Otherwise, your utility bill cannot be paid using this method. AutoPay – by Credit Card. Ensure your payments are received on time every month, eliminating late. Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit. · Many credit cards put. Your monthly rent payments can reflect positively on your credit score, but only if the credit bureaus know you're paying your rent on time. pay a debt if the borrower does not pay back a loan as agreed. Typically, rent payments, along with utility and cell phone bills, don't appear on credit.

Secured Credit Card No Checking Account Required

Secured credit cards, which require the prospective cardmember to deposit a sum of money as collateral, may be considered a kind of starter card. The typical. Secured, student, and store cards are the easiest to get. In fact, some secured card issuers do not perform credit checks. These may be the cards best suited to. A minimum security deposit of $ (maximum of $5,) is required to open this account. Your maximum credit limit will be determined by the amount of the. A secured credit card looks and operates like a regular credit card. The difference is that it requires a cash security deposit that the lender “holds” to. This deposit is collateral for the lender, making these cards less risky to issue to people with low or no credit. The required deposit amount varies by lender. A secured credit card is a type of credit card that requires the borrower to pay a deposit upfront to the issuer—which is held as collateral in case the. In short, no, you cannot apply for a secured credit card with no credit check. Financial institutions still need to vet applicants, even for secured accounts. Get Started with the Secured Credit Card · Apply. Apply for the Secured Card in our Mobile App or Online Banking service. · Provide a security deposit. When you. Use our Secured Credit Card to build better credit! By only charging a set amount each month and then showing consistent, on-time payment patterns. Secured credit cards, which require the prospective cardmember to deposit a sum of money as collateral, may be considered a kind of starter card. The typical. Secured, student, and store cards are the easiest to get. In fact, some secured card issuers do not perform credit checks. These may be the cards best suited to. A minimum security deposit of $ (maximum of $5,) is required to open this account. Your maximum credit limit will be determined by the amount of the. A secured credit card looks and operates like a regular credit card. The difference is that it requires a cash security deposit that the lender “holds” to. This deposit is collateral for the lender, making these cards less risky to issue to people with low or no credit. The required deposit amount varies by lender. A secured credit card is a type of credit card that requires the borrower to pay a deposit upfront to the issuer—which is held as collateral in case the. In short, no, you cannot apply for a secured credit card with no credit check. Financial institutions still need to vet applicants, even for secured accounts. Get Started with the Secured Credit Card · Apply. Apply for the Secured Card in our Mobile App or Online Banking service. · Provide a security deposit. When you. Use our Secured Credit Card to build better credit! By only charging a set amount each month and then showing consistent, on-time payment patterns.

With a standard, unsecured credit card, no deposit is required. With a secured credit card, the money that you borrow from your card issuer is a covered by a. Choose your own credit line based on how much money you want to put down as a security deposit. Initial deposits can be from $ to $ Citi® Secured Mastercard®: Best feature: No annual fee. Discover it® Secured Credit Card: Best feature: Secured purchases. Capital One Platinum Secured Credit. Credit Card. The funds you deposit in an Explore Card Savings Account will secure your credit card obligations while earning interest at the same time. No, you cannot open a Key Secured Credit Card without a Key Active Saver account. You'll need a Key Active Saver account to maintain the deposit amount equal to. Secured credit cards are a type of credit card that have a lower barrier to entry because they require the cardholder to pay a security deposit that guarantees. Highlights - Discover it® Secured Credit Card No credit score required to apply. No Annual Fee, earn cash back, and build your credit history. Your secured. Chime Secured Credit Builder Visa® Credit Card This card has no minimum deposit requirement, charges neither an annual fee nor interest, and doesn't require a. We know of two secured cards — the OpenSky® Secured Visa® Credit Card and Applied Bank® Secured Visa® Gold Preferred® Credit Card — that you can obtain without. Best second chance credit cards with no security deposit. Petal® 2 “Cash Back, No Fees” Visa® Credit Card *: Best second chance credit card with no security. Unlike your Prepaid Card, UNITY Visa secured card can help you build your credit. · No Minimum Credit Score required; low fixed interest rate of %; Fully. For those who might have limited credit, our Secured Visa® is a great option. Because secured credit cards require a refundable security deposit. No annual fee. No credit score required to apply Annual Fee: None. % standard variable purchase APR. Intro Balance Transfer APR is % for 6 months. Chime Secured Credit Builder Visa® Credit Card This card has no minimum deposit requirement, charges neither an annual fee nor interest, and doesn't require a. Get Started with the Secured Credit Card · Apply. Apply for the Secured Card in our Mobile App or Online Banking service. · Provide a security deposit. When you. No application fee on this Secured Credit Card · Credit Builder Secured Credit Card has no over-the-limit fee · Automatic reporting to the three major credit. Options to start your credit history · Secured credit cards. With a secured card, you first make a security deposit with the lender. This refundable security. OpenSky® Secured Visa® Credit Card: No Credit Check or Bank Account Required · Credit limit and deposit. Your credit limit is equal to your security deposit. Secured credit cards, which require the prospective cardmember to deposit a sum of money as collateral, may be considered a kind of starter card. The typical. You'll need a minimum of $ in your savings account to secure your card. You can use funds from another TD Bank, your debit card or an external account.

Iron Corridor Options

What is a iron condor? An iron condor is a neutral strategy that is profitable if the stock remains within the inner strikes B and C. It is established for a. options. It's a must-visit for diners seeking a blend of American Situated in the heart of Downtown Edmonds along the Fourth Avenue Arts Corridor. Iron condor spreads are advanced option strategies based on out-of-the-money short put and short call spreads with the same expiration month. An "Iron Condor" is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. Trading. An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with. Overview: You may buy an iron condor if you think that SPX will trade out of a specific range at expiry. If you sell an iron condor, you. An iron condor is a popular neutral options strategy with defined risk and limited profit potential. Iron condors consist of a bull put credit spread and a bear. While the name Iron Condor may be foreign to you, it's a risk-defined options strategy that is a great way to create yield. It is a strategy that has a high. This strategy has four different options contracts, each with the same expiration date and different exercise prices. The maximum potential loss. What is a iron condor? An iron condor is a neutral strategy that is profitable if the stock remains within the inner strikes B and C. It is established for a. options. It's a must-visit for diners seeking a blend of American Situated in the heart of Downtown Edmonds along the Fourth Avenue Arts Corridor. Iron condor spreads are advanced option strategies based on out-of-the-money short put and short call spreads with the same expiration month. An "Iron Condor" is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. Trading. An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with. Overview: You may buy an iron condor if you think that SPX will trade out of a specific range at expiry. If you sell an iron condor, you. An iron condor is a popular neutral options strategy with defined risk and limited profit potential. Iron condors consist of a bull put credit spread and a bear. While the name Iron Condor may be foreign to you, it's a risk-defined options strategy that is a great way to create yield. It is a strategy that has a high. This strategy has four different options contracts, each with the same expiration date and different exercise prices. The maximum potential loss.

Iron condors are a popular options trading strategy that can potentially provide traders with a limited risk and limited reward trade. See ###dimension not featured or unavailable options. See all 2 options. Updated other options based on this selection. {"mobile_buybox_group_1. Handrail for Stairs Outside Steps, Black/White/Gold Metal Wrought Iron Corridor Safty Banister Hand Railing, Handrails for Indoor Outdoor Steps - Complete. From decisive fuel choices to setting operational targets, corridors are becoming catalysts for pre-investment activities. Global Maritime Forum, December To construct a short condor, the investor sells one call while buying another call with a higher strike and sells one put while buying another put with a lower. See ###dimension not featured or unavailable options. See all 2 options. Updated other options based on this selection. {"mobile_buybox_group_1. An iron condor is an options trading strategy that involves selling both a bull put spread and a bear call spread on the same underlying security with the same. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. All. Learn how to trade with Options Trading Strategies such as calls, puts, straddles, strangles, spreads, butterflies, condors. A short iron condor spread is a four-part strategy consisting of a bull put spread and a bear call spread in which the strike price of the short put is lower. A reverse iron condor is a neutral options strategy with defined risk and limited profit potential. The strategy looks to take advantage of rising volatility. A Short Iron Condor is a strategy that involves buying a lower strike Put, selling a lower middle strike Put, selling a higher middle strike Call, and buying a. The Synthetic Long Stock strategy caters to the investor who aims to emulate the payoff of a long stock position using options. By buying a call option and. • Refine the conceptual/schematic designs of the Study Corridor improvement options. (using the detailed base mapping) to provide a basis for providing an. Iron Condor Options for Beginners: A Smart, Safe Method to Generate an Extra 25% Per Year with Just 2 Trades Per Month (Options Trading for Beginners). • Refine the conceptual/schematic designs of the Study Corridor improvement options. (using the detailed base mapping) to provide a basis for providing an. Get instant margin for trading options on Options Trader Web. Fast create using Straddle, Strangle, Iron Condor, and more based on your market outlook. This trade works best when the underlying is more volatile prior to entering the trade and then becomes less volatile during the life of the options. Also, the. neutral strategy IRON CONDOR stock price profit loss. -. +. Page Example: Sell 1 call; buy 1 call at same strike but longer expiration; also can be done.

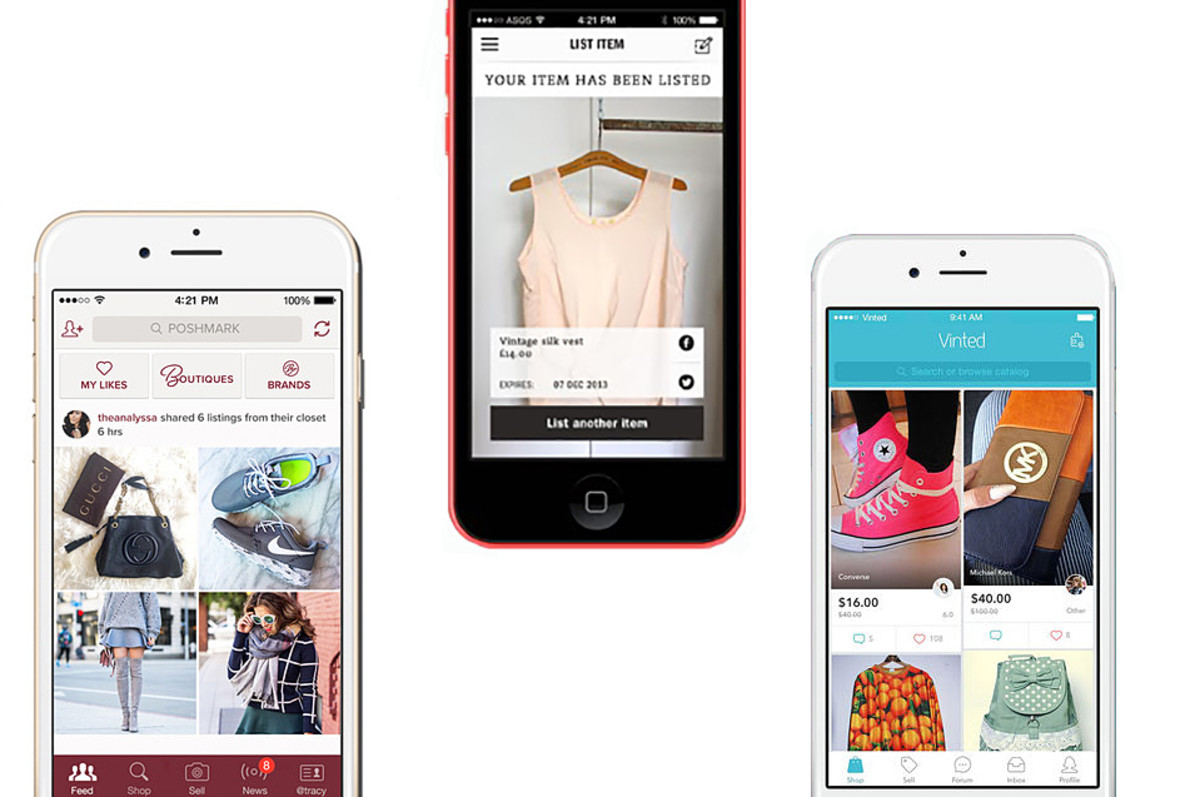

Apps That You Can Sell Clothes On

You can sell used clothing, jewelry, art, sports equipment and more on the Depop app. When someone purchases your item, you can either ship it yourself or have. Photo by FreeUp - India's largest thrifting app on July Join Vinted, your community marketplace for buying and selling pre-loved pieces. Need a clearout? Get extra money in your pocket while you do it. Car boot sales, thrift shops and second-hand clothing apps uncover a whole new world of shopping. You can even bargain for a better price on apps like Vinted! 6. Depop is the marketplace where you can explore your style. Buy clothing from a diverse community of sellers who bring fashion to life. What to expect as a buyer: Well, what can you not find on eBay? This is the platform to look for the common high street brands just as much as it is the. Best Clothing Selling Apps & places to shop for secondhand clothes: · 1. Flyp · 2. Closest Closet · 3. Lucky Sweater · 4. Vestiaire Collective · 5. Grailed · 6. You can reclaim any items that don't sell, or we'll do our best to give them a second life. Our environmental impact · Our environmental impact. 3. Earn cash or. You can use apps like Poshmark, Depop, or Vinted to sell your old clothes. These platforms are popular for reselling fashion items and are. You can sell used clothing, jewelry, art, sports equipment and more on the Depop app. When someone purchases your item, you can either ship it yourself or have. Photo by FreeUp - India's largest thrifting app on July Join Vinted, your community marketplace for buying and selling pre-loved pieces. Need a clearout? Get extra money in your pocket while you do it. Car boot sales, thrift shops and second-hand clothing apps uncover a whole new world of shopping. You can even bargain for a better price on apps like Vinted! 6. Depop is the marketplace where you can explore your style. Buy clothing from a diverse community of sellers who bring fashion to life. What to expect as a buyer: Well, what can you not find on eBay? This is the platform to look for the common high street brands just as much as it is the. Best Clothing Selling Apps & places to shop for secondhand clothes: · 1. Flyp · 2. Closest Closet · 3. Lucky Sweater · 4. Vestiaire Collective · 5. Grailed · 6. You can reclaim any items that don't sell, or we'll do our best to give them a second life. Our environmental impact · Our environmental impact. 3. Earn cash or. You can use apps like Poshmark, Depop, or Vinted to sell your old clothes. These platforms are popular for reselling fashion items and are.

Poshmark · Cost: When using Poshmark, you can expect a $ fee on any sales under $15 and up to 20% of the listing price for any item listed at $15 or more. eBay also provides convenient shipping options, including shipping labels and package tracking, which can make the selling process easier and more streamlined. It is a platform that you can use to sell and buy clothing, and it's super easy to manage. You can sell all kinds of clothing pieces on this app. What Is. Which App Is Better for Selling Online: Poshmark or thredUP? Both Poshmark and thredUP are startups that help people to buy and sell clothes online. So. From preowned clothes and designer clothing to retro sneakers, boots, shoes and jewelry – you'll find what you're looking for from our diverse community. I post all of my items on several apps- Depop, Poshmark, Mercari, and Vinted. I've had the most luck with Depop overall (over the last years), but I've. It works a lot like many social media apps – you sign up, fill in your profile (which is also your shop), and then start following other users on the app. You might associate Etsy with selling homemade craft items rather than second-hand clothes. But if you make your own or upcycle clothing, this can help you. If you have luxury designer items gathering dust in your wardrobe, selling them on high-end designer resale platforms can be an excellent way to make some extra. You can sell almost anything on this e-commerce site, with your used clothing being one of the options. You can choose from apps in the Shopify App. 2 Mercari Mercari has over 20 million users, and its app focuses on affordability, simplicity, and ease of use. You'll need photos, a title, a category, and a. The best app for selling clothes is the Shopify app. You can browse the Shopify App Store to find apps to sell new and used clothing. Other apps to help you. Whether you're looking to sell electronics, sporting goods, clothes or even cars, you can do so via eBay. You can sell using the traditional auction platform –. Whether you're looking to sell electronics, sporting goods, clothes or even cars, you can do so via eBay. You can sell using the traditional auction platform –. How To Create Website To Sell Clothes Online? Have you ever imagined that you could create a website or an app with no coding and no investment? Allow. Depop is an app that allows you to buy and sell clothes, as well as discover new brands. You can buy and sell your clothes in just seconds. Follow shops and. Letgo is an old product selling app that lets you buy and sell second-hand items locally. It's easy to use and free, with a user-friendly interface. You can. Poshmark · Cost: When using Poshmark, you can expect a $ fee on any sales under $15 and up to 20% of the listing price for any item listed at $15 or more. It works a lot like many social media apps – you sign up, fill in your profile (which is also your shop), and then start following other users on the app. If you're selling regular mall brand clothing, you can turn to ThredUp, which focuses on brands like Gap and muscles-power.ru Poshmark also accepts a wide range of.

Best Mortgage Loan For Investment Property

That means a down payment of only 20%. Choose from , , and year fixed-rate mortgages. A fixed rate means your rate will never increase over. There is no one-size-fits-all for mortgage financing. The best way to determine whether an investment property loan makes the most sense for you is to talk to. What type of loan is best for your investment property? ; Conventional loan. You don't want to live at the property; You have a strong credit profile and well-. What Is an Investment Property Loan? As a mortgage loan for a commercial building is typically higher risk, they generally have higher interest rates. If you're looking to generate income from real estate, MECU in MD offers low-cost residential investment property loans. Learn more and apply online. Current mortgage rates by loan type ; year fixed rate. %. % ; FHA year fixed rate. %. % ; year 5/1 ARM. %. % ; VA year 5/1 ARM. Mortgages for investment properties can range from 50 to basis points higher than mortgage rates on primary properties. As an option, if you currently own a home you may be able to use your current home equity to finance buying additional property. To learn more about real estate. In general, lenders require a minimum credit score of when financing a rental property. However, in order to secure the best interest rates and terms, you. That means a down payment of only 20%. Choose from , , and year fixed-rate mortgages. A fixed rate means your rate will never increase over. There is no one-size-fits-all for mortgage financing. The best way to determine whether an investment property loan makes the most sense for you is to talk to. What type of loan is best for your investment property? ; Conventional loan. You don't want to live at the property; You have a strong credit profile and well-. What Is an Investment Property Loan? As a mortgage loan for a commercial building is typically higher risk, they generally have higher interest rates. If you're looking to generate income from real estate, MECU in MD offers low-cost residential investment property loans. Learn more and apply online. Current mortgage rates by loan type ; year fixed rate. %. % ; FHA year fixed rate. %. % ; year 5/1 ARM. %. % ; VA year 5/1 ARM. Mortgages for investment properties can range from 50 to basis points higher than mortgage rates on primary properties. As an option, if you currently own a home you may be able to use your current home equity to finance buying additional property. To learn more about real estate. In general, lenders require a minimum credit score of when financing a rental property. However, in order to secure the best interest rates and terms, you.

The three best lenders we've found for long-term landlord mortgages are Visio, Kiavi, and Lending One. All are collateral-based lenders, more interested in the. Based on that average, an investment property borrower with excellent credit who qualifies for the most competitive investment property rate might receive %. In other words, if the equivalent consumer mortgage rate is %, the rate for a single-family investment property will be % to %. leads. Investment. Investment Property Loans · Fannie Mae Delayed Financing Program: This program is designed for those investors who have purchased a home in full with no mortgage. Get flexible financing options for your investment properties with a year conventional fixed-rate mortgage and no PMI through Navy Federal Credit Union. Discover investment property mortgage rates, down payments, and loan requirements with The Texas Mortgage Pros. Secure the best mortgage for your rental. Exchange Webinar · Mortgage Rates for Primary or Secondary Residences · Fixed-Rate First Mortgage * as low as % (% APR) · Adjustable-Rate Mortgage. In addition to the down payment, investment property mortgage lenders require 6 months of cash reserves available per property. In other words, if you own a. These Freddie Mac mortgage options can help lenders originate 1- to 4-unit investment property mortgages mortgages eligible for sale best efforts or. Hard money loan: A hard money loan is a type of short-term loan that is often used for real estate investing. It is typically secured by the. Looking to buy an investment property? We offer fixed & adjustable-rate investment property and second home loan options. Learn more and get prequalified. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. Current mortgage rates by loan type ; year fixed rate. %. % ; FHA year fixed rate. %. % ; year 5/1 ARM. %. % ; VA year 5/1 ARM. Conventional loans are a popular choice for investment properties. They offer competitive interest rates and flexible terms. However, they often require a. When you're looking to purchase a rental property, get your investment property loan from a top Wisconsin Lender, with branches in both Madison and. A blanket loan is a good option for real estate investors who want to purchase several rental properties and finance all of them using a single loan or. Best Mortgage Lender for Alternative Credit Data Eligibility. Flagstar Bank. Flagstar Bank. Forbes Advisor. With this program, you only need to put down 15% on your single family investment property home purchase, enabling you to maximize your capital and purchase. to closing. Nerdwallet's Best Mortgage Lender. divider. “The entire process went smoothly. The loan got funded on time and it was a tight schedule. Flip Funding: Best overall investment property loan Loan terms up to 30 yrs. Data effective 12/21/ Offers and availability may vary by location and are.